By December, the Nigerian economy changes gear. Markets stay open late, transport fares swing wildly, and money—whether earned, borrowed, or sent home—moves faster than at any other time of the year. Christmas is not just a religious or cultural season in Nigeria; it is an economic event with clear winners, pressure points, and long-term consequences for households and businesses alike.

In 2025, with inflation still shaping consumer behavior and household incomes under pressure, the “Christmas economy” reflects both resilience and strain. Nigerians continue to celebrate—but with sharper financial calculations.

- Spending Patterns: Celebration Meets Cost Control

Christmas remains one of the highest-spending periods in Nigeria. Households typically allocate money across five major areas: food, clothing, parties, gifts, and travel.

Food and parties account for the largest share.

Rice, chicken, beef, cooking oil, spices, and drinks dominate December shopping lists. Despite rising food prices, families prioritize “Christmas food,” often cutting back elsewhere during the year to make December special.

Party spending—end-of-year office events, family gatherings, street celebrations, and weddings—injects billions of naira into catering, event planning, drinks, rentals, and entertainment.

However, 2025 shows a shift toward smarter spending. More Nigerians are:

Sharing costs for joint family parties

Hosting home-based events instead of rented halls

Buying food items earlier in November to hedge against December price spikes

Luxury is no longer the default; value is.

- Transport & Travel: The Price of Going Home

December travel is both emotional and expensive. The annual movement from cities to villages—popularly called “going home for Christmas”—creates intense pressure on Nigeria’s transport system.

Bus fares often double or triple between mid-December and Christmas Eve.

Flight tickets, especially to eastern and southern states, sell out weeks in advance, with prices peaking between December 18–24.

Fuel availability and road conditions continue to influence costs, as transporters pass higher operating expenses to passengers.

Many families now choose staggered travel—sending children or one parent earlier—while others opt for virtual celebrations, especially when costs outweigh sentiment.

Yet, transport remains one of the biggest beneficiaries of the Christmas economy, with transport unions, ride-hailing drivers, and logistics companies recording some of their highest earnings of the year.

- Gifting: Modest, Meaningful, and Strategic

Gift-giving in Nigeria has evolved. While cash gifts (“Christmas money”) remain popular—especially for children—2025 shows a move toward practical gifting.

Common gifts include:

Clothing and shoes

Food items and hampers

School-related items for children

Small electronics and household appliances

Corporate gifting also plays a major role. Companies distribute hampers, bonuses, or branded items to staff and partners, making December a peak season for retail wholesalers and packaging businesses.

Social media and e-commerce platforms have reshaped gifting behavior, making it easier to compare prices and avoid impulse buying—though delivery delays remain a December challenge.

- Saving Before December: Planned Discipline or Forced Restraint

For many Nigerians, Christmas spending begins months earlier. Cooperative societies, informal savings groups (ajo/esusu), and digital savings platforms see higher activity from August to November as households prepare for year-end expenses.

However, not all savings are intentional. Some families are forced to save by cutting back on leisure spending during the year, knowing December demands are unavoidable.

A growing trend in 2025 is December-only savings withdrawals:

Cooperatives releasing lump sums

End-of-year bonuses being delayed specifically for festive use

Salary earners timing leave allowances and 13th-month payments

Despite these efforts, savings rarely fully cover December expenses.

- Borrowing: The Hidden Cost of Celebration

Christmas borrowing is one of the least discussed aspects of the festive economy—but one of the most impactful.

Borrowing sources include:

Salary advances

Cooperative loans

Digital lending apps

Informal loans from friends and family

Many borrowers justify December loans as “short-term,” expecting January pay or bonuses to cover repayments. In reality, January often comes with school fees, rent, and other obligations, creating a post-Christmas debt hangover.

Digital lenders report spikes in December borrowing, followed by higher default rates in January and February. This cycle highlights how festive pressure can undermine long-term financial stability.

- Remittances: Diaspora Money Powers December

Diaspora remittances play an outsized role in Nigeria’s Christmas economy. December consistently records one of the highest inflows of foreign currency into the country.

Remittances are primarily used for:

Family celebrations

Building projects unveiled at Christmas

Community development events

Direct cash gifts to relatives

In 2025, with exchange rate considerations still top-of-mind, many families wait specifically for December transfers, stretching funds to cover both celebration and investment.

For some households, Christmas would simply not happen without diaspora support.

- Winners of the Christmas Economy

Certain sectors consistently benefit:

Food producers, traders, and cold-room operators

Transport and logistics businesses

Fashion designers and tailors

Entertainment, media, and nightlife

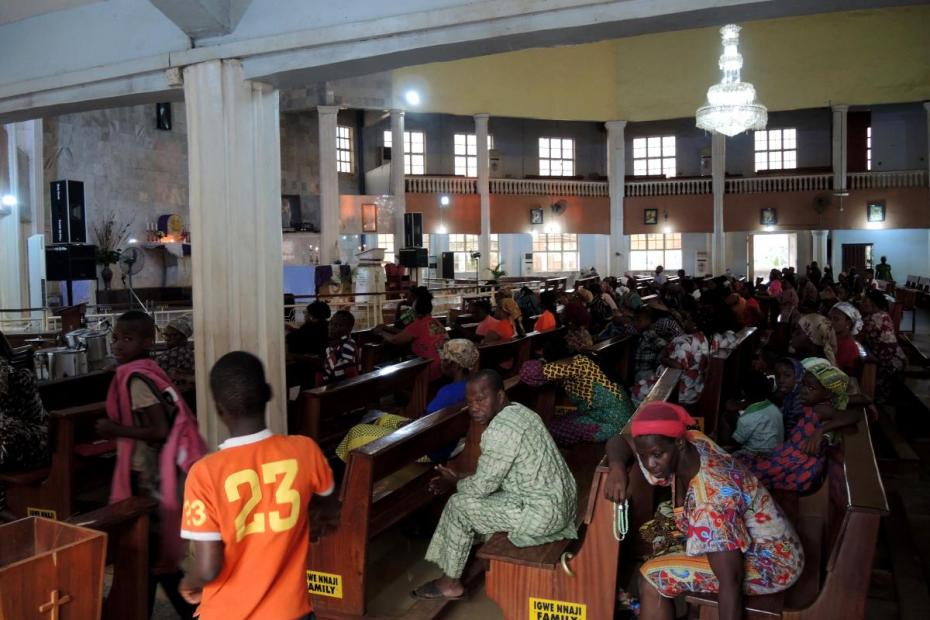

Religious institutions hosting end-of-year programs

December profits often subsidize slower months that follow, making Christmas survival critical for many small businesses.

- The January Reality

The Christmas economy doesn’t end on December 25 or 31—it spills into January. Households face depleted savings, outstanding debts, and reduced income as businesses slow down.

More Nigerians now talk openly about “soft landing January”—reducing celebrations, avoiding borrowing, and prioritizing liquidity. Financial literacy campaigns and media discussions have started changing the narrative: celebrate, but don’t collapse.

Celebration with Consequences

Christmas in Nigeria remains a powerful blend of faith, family, culture, and commerce. Even under economic pressure, Nigerians find ways to celebrate—but the financial decisions made in December echo far beyond the season.

In 2025, the Christmas economy tells a deeper story: one of adaptation, sacrifice, community support, and difficult trade-offs. The challenge ahead is not how to stop celebrating—but how to celebrate without mortgaging the year ahead.